In the labyrinth of personal finance, there exists a three-digit cipher—a code that holds the power to unlock doors to financial opportunities or keep them firmly closed. This secret code, known to the world as the credit score, is more than just a number; it's a reflection of your financial trustworthiness, a beacon that signals to lenders just how reliable you are when it comes to managing money. But what exactly is a credit score, why does it wield such power, and how can it shape your financial journey? Let's dive into the world of credit scores and uncover their mysteries.

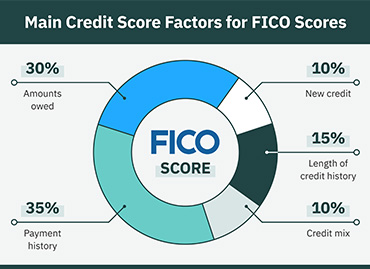

Imagine if your entire financial history was distilled into a single number. This number, your credit score, is calculated based on your past interactions with credit—be it through loans, credit cards, or any debt you've taken on. Ranging from 300 to 850, this score is your financial report card, with higher scores signaling to lenders that you're a safe bet, and lower scores suggesting you might be a riskier proposition.

Why does this number matter so much? Your credit score is the key to unlocking financial opportunities. Dream of owning a home? Your score can make that dream a reality or keep it at arm's length. Looking to finance a car, get a personal loan, or snag that rewards credit card with all the perks? Your credit score is the gatekeeper, determining not just whether you'll be approved but also the terms of the deal. A high score can lead to lower interest rates, better loan terms, and can save you thousands of dollars over time. On the flip side, a lower score can lead to higher interest rates, hefty deposits, or outright rejection.

"Every problem is a gift—without problems, we would not grow." - Tony Robbins

Understanding your credit score is the first step on a journey of financial enlightenment. It's about recognizing the power this number holds and taking control of it. Improving your credit score is akin to unlocking higher levels in a game, where each level up opens new doors and opportunities. Paying bills on time, keeping credit card balances low, and managing debt wisely are just a few strategies to boost your score.

Embarking on the quest to understand and improve your credit score is not just about numbers. It's about taking charge of your financial destiny, making informed decisions, and unlocking the best life has to offer. In the grand tapestry of personal finance, your credit score is a critical thread, weaving through nearly every aspect of your financial life. By mastering it, you're not just improving a number—you're paving the way for a brighter financial future..

So, as you stand at the threshold of financial opportunities, remember that your credit score is both a reflection of your past and a map to your future. Treat it with care, nurture it, and watch as it opens doors to a world of possibilities. Welcome to the secret society of credit score wizards—may your journey be prosperous and your score ever in your favor.