Embark on a journey to unravel the intricate workings of credit scoring, where each factor meticulously shapes your financial landscape. Picture your credit score as a complex mosaic, with each piece representing a different facet of your financial behavior. Understanding the anatomy of this crucial numerical representation is akin to deciphering a code that tells a story of how you manage money.

At the core of credit scoring lie several key factors, each playing a distinct role in determining your creditworthiness. The backbone of your score is your payment history, carrying the most weight at 35%. This factor reflects your track record of paying bills on time, signaling reliability to lenders. Conversely, missed or late payments can significantly impact your score.

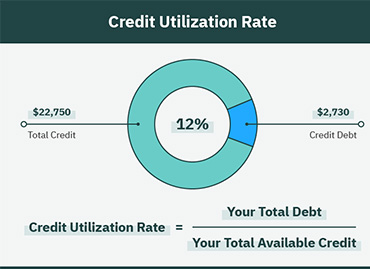

Credit utilization, accounting for 30% of your score, measures the balance between the credit you're using and your available credit limits. Keeping your utilization below 30% is crucial, demonstrating responsible debt management. Additionally, the length of your credit history, types of credit in use, and new credit inquiries each contribute to shaping your score, albeit to varying degrees.

"Understanding the anatomy of your credit score is like decoding the language of financial trust, where each factor tells a story of your money management habits." - Anonymous

Beyond the numerical calculations, nuances exist within credit scoring models and lender criteria. Understanding these variations empowers you to make informed decisions that positively influence your financial future. Whether it's prioritizing on-time payments, managing credit utilization, or diversifying your credit portfolio, each action contributes to a healthier credit score.

As you embark on this journey of financial awareness, remember that every decision matters. By sculpting a future where financial opportunities abound, you craft a picture of financial health that opens doors to your dreams. With each careful step, you're not just navigating the present; you're paving the way for a brighter financial future, where your credit score is a testament to your financial acumen and responsibility.